Press Release

BOC Aviation Reports Solid Earnings For 2021

10 Mar 2022

BOC Aviation Limited (“BOC Aviation” or the “Company”) is pleased to announce its audited financial results for the full year ended 31 December 2021.

Robert Martin, Managing Director and Chief Executive Officer, said: “As the world commenced its recovery from the downturn, BOC Aviation’s 2021 earnings rose in line with better airline customer cashflows and rising activity levels across the aviation industry. In 2021, net profit after tax was US$561 million, up 10% year-on-year, and we will recommend to shareholders to approve a final dividend of 28.31 US cents per share, in line with our dividend policy to pay up to 35% of net profit after tax.

Total revenues and other income rose to US$2.2 billion in 2021, up 6% year-on-year, while our total assets were US$23.9 billion as at 31 December 2021, from US$23.6 billion as at 31 December 2020. We continued to generate robust operating cash flows net of interest of US$1.3 billion, which maintained a similar level to 2020.

During 2021, we delivered aircraft to our airline customers at the rate of one per week and ended the year with an owned and managed fleet of 417 aircraft. As the year progressed our airline customers moved from reacting to the events of the then present to positioning themselves and their fleets for the future. Commercial aircraft orders at Boeing and Airbus started to rise as airlines began to look forward to the resumption of passenger demand growth. Financing these, our own orderbook and the manufacturers’ existing backlog of deliveries will provide growth opportunities in 2022 and beyond for our Company. BOC Aviation is well positioned with a strong balance sheet and our US$6 billion in liquidity.

Our thanks go out once more to our colleagues, our directors and our stakeholders, who contributed to resilient results in another challenging year. We appreciate your focus and tenacity as the market now rebounds from the worst downturn in aviation history.”

Financial Highlights

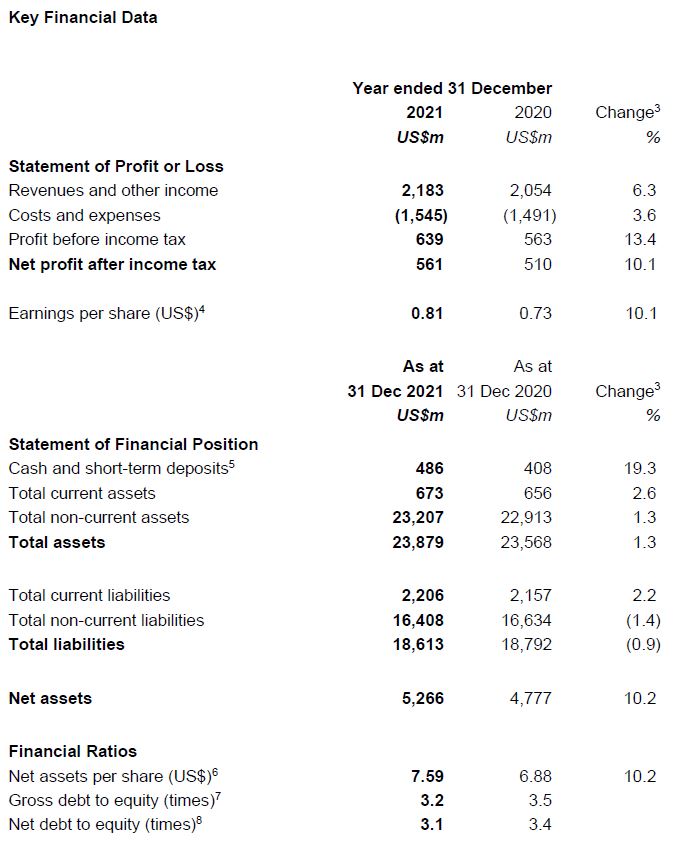

Our financial highlights for the year ended 31 December 2021 are:

- Total revenues and other income were up 6% year-on-year, at US$2.2 billion

- Profit before tax was US$639 million and net profit after tax was US$561 million, rising 13% and 10% respectively from 2020

- Earnings per share of US$0.81 and net assets per share of US$7.59

- Total assets were stable year-on-year, at US$23.9 billion at 31 December 2021

- Raising US$3.5 billion in new financing

- Maintaining strong liquidity with US$485 million in cash and cash equivalents, and US$5.6 billion in undrawn committed credit facilities at 31 December 2021

- Stable operating cash flows net of interest at US$1.3 billion

- Board recommending a final dividend for 2021 of US$0.1733 per share, pending approval at the AGM to be held on 9 June 2022. The final dividend will be payable to Shareholders registered at the close of business on the record date, being 17 June 2022, bringing the total dividend for the financial year 2021 to US$0.28311 per share

Portfolio and Operational Highlights

As at 31 December 2021, BOC Aviation had:

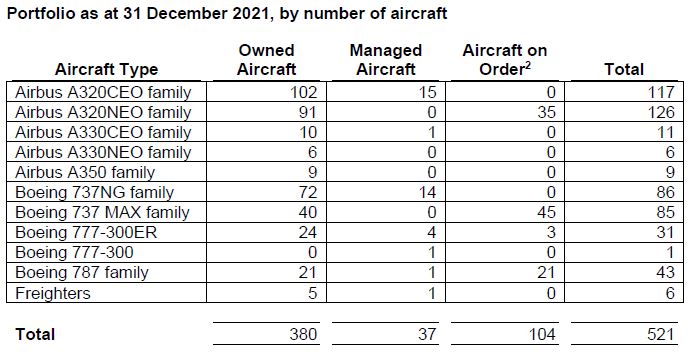

- A total fleet of 521 aircraft owned, managed and on order2, with an average aircraft age of 3.9 years and an average remaining lease term of 8.3 years for the 380 owned aircraft fleet, weighted by net book value

- Leased aircraft to 86 airlines in 38 countries and regions

- Taken delivery of 52 aircraft (including seven acquired by airline customers on delivery) in 2021

- Executed 160 transactions in 2021, including 74 lease commitments

- Sold 26 aircraft in 2021, including 23 from the owned fleet

- An orderbook of 104 aircraft2

- Recorded aircraft utilisation of 98.5% for the owned portfolio for the year ended 31 December 2021

Note: Due to rounding, numbers presented throughout this announcement may not add up precisely to the totals provided and percentages may not precisely reflect the absolute figures.

The full year 2021 financial results presentation slides and consolidated financial statements are available on the Company website at /en/Investors/Financial-Results, along with a recording of the earnings conference call that will be made available on 11 March 2022.

Notes:

- Includes interim dividend of US$0.1098 per share paid to Shareholders registered at the close of business on 4 October 2021.

- Includes all commitments to purchase aircraft including those where an airline customer has the right to acquire the relevant aircraft on delivery.

- Percentage change is calculated based on numbers in US$ thousands as shown in the financial statements.

- Earnings per share is calculated by dividing net profit after tax by total number of shares outstanding at 31 December 2021 and 31 December 2020. Number of shares outstanding at 31 December 2021 and 31 December 2020 was 694,010,334.

- Includes encumbered cash and bank balances of US$1.2 million as at 31 December 2021 and less than US$1,000 at 31 December 2020.

- Net assets per share is calculated by dividing net assets by total number of shares outstanding at 31 December 2021 and 31 December 2020.

- Gross debt to equity is calculated by dividing gross debt by total equity at 31 December 2021 and 31 December 2020.

- Net debt is defined as gross debt less cash and short-term deposits. Net debt to equity is calculated by dividing net debt by total equity.

About BOC Aviation

BOC Aviation is a leading global aircraft operating leasing company with a fleet of 521 aircraft owned, managed and on order. Its owned and managed fleet was leased to 86 airlines in 38 countries and regions worldwide as at 31 December 2021. BOC Aviation is listed on the Hong Kong Stock Exchange (HKEx code: 2588) and has its headquarters in Singapore with offices in Dublin, London, New York and Tianjin. For more information, visit www.bocaviation.com.

*******

For more information, please contact:

Timothy ROSS

Tel: +65 6325 9878

Mobile: +65 9837 9873

[email protected]

www.bocaviation.com