Press Release

BOC Aviation Reports 1H 2021 Performance

19 Aug 2021

BOC Aviation Limited (HKEX Code: 2588, “BOC Aviation”) is pleased to announce its unaudited results for the six months ended 30 June 2021.

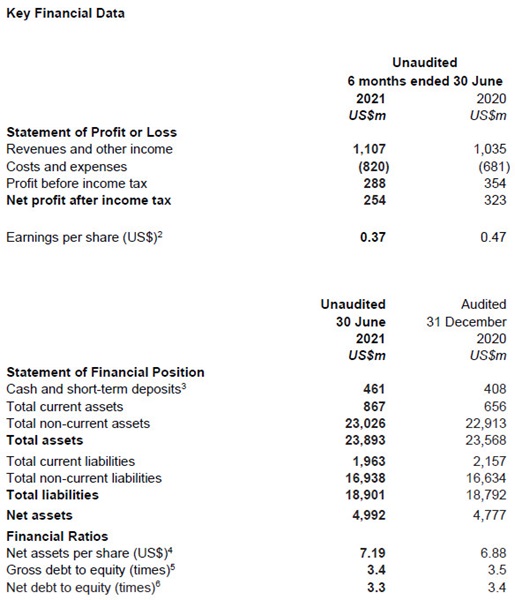

BOC Aviation reported net profit after tax (“NPAT”) of US$254 million for the first half of 2021. Profitability has improved since the second half of 2020, as the earnings and cash flow outlook improved for most of our airline customers, particularly in China, Europe and USA.

During the six months ended June 2021, we generated positive operating cash flow net of interest expenses of US$557 million and ended the half year with a record US$5.8 billion in available liquidity.

The Board of Directors approved a distribution of US$0.1098 per share by way of interim dividend, which represents 30% of our NPAT in the first half of 2021 and is the same proportion of NPAT that we distributed as an interim dividend in prior years.

“BOC Aviation’s underlying earnings continued to improve during 1H 2021 with profit before tax and impairment charges rising 5% to US$434 million, reflecting our disciplined investment in modern aircraft, placed on long term leases to high quality airline customers,” Robert Martin, Managing Director and Chief Executive Officer, BOC Aviation, commented. “We celebrated our fifth year as a listed company in June and have generated over US$5 billion in cumulative earnings since our inception 27 years ago.”

Financial Highlights

Our financial highlights for the six months ended 30 June 2021 are:

- Total revenues and other income increased 7% to US$1,107 million

- Profit before tax and charges for impairment of aircraft and financial assets of US$434 million, up 5% from US$412 million in the first half of 2020

- Operating cash flow net of interest increased 0.4% in the first six months of 2021 compared with 1H 2020

- Net profit after tax declined to US$254 million, compared with US$323 million in the first half of 2020

- Earnings per share of US$0.37

- Interim dividend of US$0.1098 per share, maintaining the same payout ratio as in previous years

- Total assets increased to US$23.9 billion as at 30 June 2021 from US$23.6 billion as at 31 December 2020

- Raised US$2 billion in new financing

- Maintained strong liquidity with US$460 million in cash and cash equivalents in addition to US$5.4 billion in undrawn committed revolving credit facilities as at 30 June 2021

Portfolio and Operational Highlights

Our operational transactions as at 30 June 2021 included:

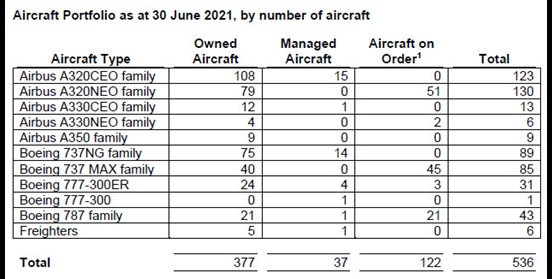

- A portfolio of 5361 owned, managed and committed aircraft

- Owned fleet of 377 aircraft, with an average age of 3.7 years and an average remaining lease term of 8.1 years, each weighted by net book value

- An orderbook of 1221 aircraft scheduled for delivery through to 31 December 2024

- Total deliveries of 34 aircraft, including six acquired by airline customers on delivery, in the first half of 2021

- Signed 26 lease commitments in the first half of 2021, with all aircraft scheduled for delivery from our orderbook before 2023 placed with airline customers

- Customer base of 87 airlines in 38 countries and regions in the owned and managed fleet

- Sold nine aircraft from the owned fleet and three from the managed fleet

- Owned aircraft utilisation at 99.6%, with six twin aisle aircraft (all of which are now subject to new leases) and two single aisle aircraft off lease at 30 June 2021

- Managed fleet comprised 37 aircraft, with two single aisle aircraft off lease at 30 June 2021

Certain airline customers notified us of their intention to acquire on delivery a total of 14 of our aircraft on order, five of which are expected to be delivered in the second half of 2021.

The first half 2021 financial results presentation slides and unaudited interim condensed consolidated financial statements are available on the Company website at https://www.bocaviation.com/en/Investors/Financial-Results, along with a recording of the earnings conference call that will be made available by 20 August 2021.

Due to rounding, numbers presented may not add up precisely to the totals provided and percentages may not precisely reflect the absolute figures.

- Includes all commitments to purchase aircraft including those where an airline customer has the right to acquire the relevant aircraft on delivery.

- Earnings per share is calculated by dividing net profit after tax by total number of shares outstanding at 30 June 2021 and 30 June 2020. Number of shares outstanding at 30 June 2021 and 30 June 2020 was 694,010,334.

- Includes encumbered cash and bank balances of US$456,000 and less than US$1,000 at 30 June 2021 and at 31 December 2020, respectively.

- Net assets per share is calculated by dividing net assets by total number of shares outstanding at 30 June

2021 and 31 December 2020. Number of shares outstanding at 31 December 2020 was 694,010,334.

- Gross debt to equity is calculated by dividing gross debt by total equity at 30 June 2021 and 31 December 2020.

- Net debt is defined as gross debt less cash and short-term deposits. Net debt to equity is calculated by dividing net debt by total equity.

About BOC Aviation

BOC Aviation is a leading global aircraft operating leasing company with a fleet of 536 aircraft owned, managed and on order. Its owned and managed fleet was leased to 87 airlines worldwide in 38 countries and regions as at 30 June 2021. BOC Aviation is listed on the Hong Kong Stock Exchange (HKEx code: 2588) and has its headquarters in Singapore with offices in Dublin, London, New York and Tianjin. For more information, visit www.bocaviation.com.

*******

For more information, please contact:

Timothy ROSS

Tel: +65 6325 9878

Mobile: +65 9837 9873

[email protected]

www.bocaviation.com