Press Release

BOC Aviation Reports 1H 2022 Performance

18 Aug 2022

BOC Aviation Limited (HKEX Code: 2588, “BOC Aviation”) is pleased to announce its unaudited results for the six months ended 30 June 2022.

BOC Aviation reported net loss after tax of US$313 million for the first half of 2022. The primary reason for the loss is the write-down of the net book value of 17 aircraft that remain in Russia of US$804 million. This was partially offset by cash collateral held in respect of those aircraft of US$223 million and tax credits of US$63 million. Excluding this impact, our core net profit after tax (“NPAT”) was US$206 million.

During the six months ended June 2022, we generated positive operating cash flow net of interest expense of US$717 million and ended the half year with US$6 billion in available liquidity.

The Board of Directors approved a distribution of US$0.0889 per share by way of interim dividend, which represents 30% of our core NPAT in the first half of 2022 and reflects the Board’s confidence in our business outlook.

“In the first half, BOC Aviation generated core NPAT of US$206 million, which demonstrates the resilience of our underlying business,” Robert Martin, Managing Director and Chief Executive Officer, BOC Aviation, commented. “Our balance sheet strength and high levels of liquidity position us well to continue producing long-term sustainable earnings for our shareholders.”

Financial Overview

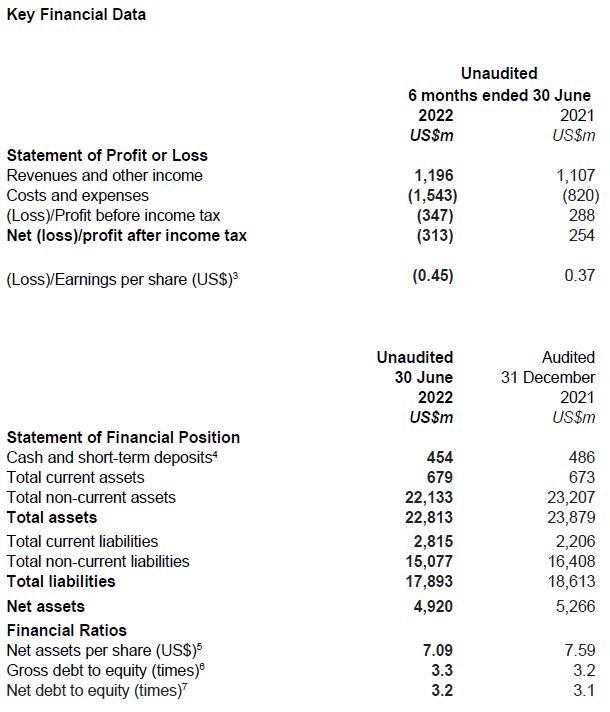

An overview of our financial position for the six months ended 30 June 2022 includes:

- Total revenues and other income increased 8% to US$1,196 million compared with the first half of 2021

- Operating cash flow net of interest increased 29% to US$717 million compared with the first half of 2021

- Net loss after tax of US$313 million, compared with net profit after tax of US$254 million in the first half of 2021. This included write-downs of US$804 million related to the net book value of aircraft remaining in Russia, partially offset by US$223 million of cash collateral held by the Group in respect of those aircraft and US$63 million of tax credits, resulting in an after tax impact of US$518 million

- Loss per share of US$0.45

- Interim dividend of US$0.0889 per share

- Total assets decreased 4% to US$22.8 billion as at 30 June 2022 compared with 31 December 2021, primarily on account of the write-down of the net book value of aircraft remaining in Russia

- Maintained strong liquidity with US$454 million in cash and short-term deposits1 in addition to US$5.5 billion in undrawn committed credit facilities as at 30 June 2022

Portfolio and Operational Overview

Our operational overview as at 30 June 2022 included:

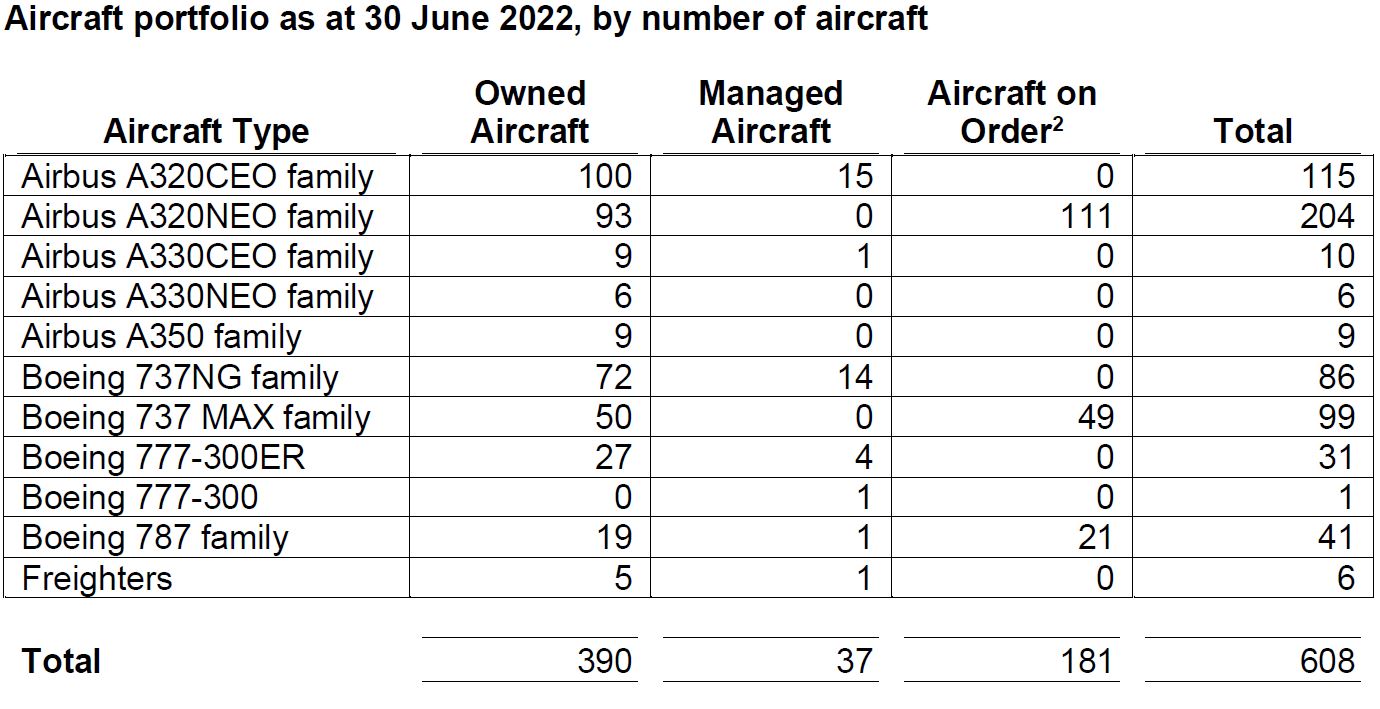

- A portfolio of 6082 aircraft owned, managed and on order

- Owned fleet of 390 aircraft, with an average age of 4.1 years and an average remaining lease term of 8.4 years, each weighted by net book value

- An orderbook of 1812 aircraft scheduled for delivery through to 31 December 2029

- Total new aircraft deliveries of 20 aircraft, including five acquired by airline customers on delivery, in the first half of 2022

- Transitioned six used aircraft to airline customers

- Sold five aircraft from the owned fleet

- Signed 46 lease commitments in the first half of 2022

- Customer base of 79 airlines in 36 countries and regions in the owned and managed fleet

- Owned aircraft utilisation at 96.1%

- Cash collection from airline customers of 96.9% for the first half of 2022 compared with 95.9% in the first half of 2021

- Managed fleet comprised 37 aircraft

The first half 2022 financial results presentation slides and unaudited interim condensed consolidated financial statements are available on the Company website at https://www.bocaviation.com/en/Investors/Financial-Results, along with a recording of the earnings conference call that will be made available by 19 August 2022.

Due to rounding, numbers presented may not add up precisely to the totals provided and percentages may not precisely reflect the absolute figures.

- Includes encumbered cash and bank balances of US$3.2 million.

- Includes all commitments to purchase aircraft including those where an airline customer has the right to acquire the relevant aircraft on delivery.

- (Loss)/Earnings per share is calculated by dividing net (loss)/profit after tax by total number of shares outstanding at 30 June 2022 and 30 June 2021. Number of shares outstanding at 30 June 2022 and 30 June 2021 was 694,010,334.

- Includes encumbered cash and bank balances of US$3.2 million and US$1.2 million at 30 June 2022 and at 31 December 2021, respectively.

- Net assets per share is calculated by dividing net assets by total number of shares outstanding at 30 June 2022 and 31 December 2021. Number of shares outstanding at 31 December 2021 was 694,010,334.

- Gross debt to equity is calculated by dividing gross debt by total equity at 30 June 2022 and 31 December 2021.

- Net debt is defined as gross debt less cash and short-term deposits. Net debt to equity is calculated by dividing net debt by total equity.

About BOC Aviation

BOC Aviation is a leading global aircraft operating leasing company with a fleet of 608 aircraft owned, managed and on order. Its owned and managed fleet was leased to 79 airlines in 36 countries and regions worldwide as at 30 June 2022. BOC Aviation is listed on the Hong Kong Stock Exchange (HKEx code: 2588) and has its headquarters in Singapore with offices in Dublin, London, New York and Tianjin. For more information, visit www.bocaviation.com.

*******

For more information, please contact:

Timothy ROSS

Tel: +65 6325 9878

Mobile: +65 9837 9873

[email protected]

www.bocaviation.com